Margins

Below are the exchange minimum margin requirements, standard intraday margins¹ for some of the more popular contracts (margin requirements for all contracts may be viewed in the trading platforms) and EIMS² for all markets offered. Maintenance margins for position traders is 10% lower than the initial margins. Please note that the margin requirements are subject to change without notice. Please see bottom of page for more details.

| Contract | Symbol | Exchange | Initial Margin | Day Trade Margin | EIMS |

|---|---|---|---|---|---|

| All CME Group and ICE contracts offered - only the most popular shown -

Updated October 29, 2024 | |||||

| Currencies | |||||

| Australian Dollar future | 6A | CME | $1,760 | $440 | $250 |

| British Pound future | 6B | CME | $2,090 | $523 | $250 |

| Canadian Dollar future | 6C | CME | $1,370 | $344 | $250 |

| Dollar Index future | DX | ICE | $1,738 | $435 | $250 |

| Euro Currency future | 6E | CME | $3,080 | $770 | $250 |

| Japanese Yen future | 6J | CME | $3,960 | $990 | $250 |

| Swiss Franc future | 6S | CME | $5,060 | $1,265 | $250 |

| E-micro AUD/USD future | M6A | CME | $176 | $44 | $50 |

| E-micro GBP/USD future | M6B | CME | $209 | $52 | $50 |

| E-micro EUR/USD future | M6E | CME | $308 | $77 | $50 |

| E-micro CAD/USD future | MCD | CME | $138 | $35 | $50 |

| E-micro CHF/USD future | MSF | CME | $506 | $127 | $50 |

| Crypto Currencies | |||||

| Micro Bitcoin future | MBT | CME | $1,870 | $468 | $250 |

| Energy | |||||

| Crude Oil future | CL | NYMEX | $5,810 | $1,453 | $500 |

| Eminy Crude Oil future | QM | NYMEX | $2,916 | $729 | $250 |

| Micro Crude Oil | MCL | NYMEX | $583 | $146 | $50 |

| Eminy Natural Gas future | QG | NYMEX | $627 | $157 | $100 |

| Heating Oil future | HO | NYMEX | $6,798 | $1,700 | $500 |

| Natural Gas future | NG | NYMEX | $2,487 | $622 | $250 |

| RBOB Gas future | RB | NYMEX | $5,495 | $1,374 | $500 |

| Brent Crude future | BRN | ICE | $5,841 | $1,460 | N/A |

| Grains and Oilseeds | |||||

| Corn future | ZC | CBOT | $1,155 | $289 | N/A |

| Oats future | ZO | CBOT | $1,375 | $344 | N/A |

| Rough Rice future | ZR | CBOT | $1,540 | $385 | N/A |

| Soybean future | ZS | CBOT | $2,200 | $550 | N/A |

| Soybean Meal future | ZM | CBOT | $2,310 | $578 | N/A |

| Soybean Oil future | ZL | CBOT | $1,870 | $468 | N/A |

| Wheat future | ZW | CBOT | $1,925 | $481 | N/A |

| Hard Red Wheat | KE | CBOT | $2,090 | $523 | N/A |

| Minneapolis Wheat future | MWE | MGEX | $2,090 | $523 | N/A |

| Mini Corn | XC | CBOT | $231 | $58 | N/A |

| Mini Wheat | XW | CBOT | $385 | $96 | N/A |

| Mini Soybean | XK | CBOT | $440 | $110 | N/A |

| Equity Index Markets | |||||

| Emini Nasdaq future | NQ | CME | $24,420 | $6,105 | $500 |

| Emini Russell future | RTY | CME | $8,360 | $2,090 | $500 |

| Emini S&P 500 future | ES | CME | $16,060 | $4,015 | $500 |

| Mini Dow Jones future | YM | CBOT | $11,440 | $2,860 | $500 |

| Nikkei 225 future | NKD | CME | $14,300 | $3,575 | N/A |

| Micro Emini S&P 500 | MES | CME | $1,606 | $402 | $50 |

| Micro Emini Nasdaq 100 | MNQ | CME | $2,442 | $611 | $50 |

| Micro Emini Russell 2000 | M2K | CME | $836 | $209 | $50 |

| Micro Emini Dow | MYM | CBOT | $1,144 | $286 | $50 |

| Interest Rates | |||||

| 2 Yr Tnote future | ZT | CBOT | $1,265 | $316 | $50 |

| Micro 2-Year Yield | 2YY | CBOT | $363 | $91 | $50 |

| 5 Yr Tnote future | ZF | CBOT | $1,430 | $358 | $100 |

| Micro 5 Year Yield | 5YY | CBOT | $352 | $88 | $50 |

| 10 Yr Tnote future | ZN | CBOT | $2,200 | $550 | $200 |

| Micro 10 Year Yield | 10Y | CBOT | $352 | $88 | $50 |

| 30 Yr Tbonds future | ZB | CBOT | $4,070 | $1,018 | $500 |

| Micro 30 Year Yield | 30Y | CBOT | $297 | $74 | $50 |

| Livestock and Meat | |||||

| Feeder Cattle future | GF | CME | $4,538 | $1,135 | N/A |

| Lean Hogs future | HE | CME | $1,650 | $413 | N/A |

| Live Cattle future | LE | CME | $2,420 | $605 | N/A |

| Metals | |||||

| Copper future | HG | COMEX | $6,600 | $1,650 | $500 |

| E-mini Copper future | QC | COMEX | $3,300 | $825 | N/A |

| Gold future | GC | COMEX | $12,100 | $3,025 | $500 |

| miNY Gold future | QO | COMEX | $6,050 | $756 | $250 |

| E-micro Gold future | MGC | COMEX | $1,210 | $303 | $50 |

| Platinum | PL | COMEX | $3,080 | $770 | N/A |

| Silver future | SI | COMEX | $13,200 | $3,300 | $1,000 |

| miNY Silver future | QI | COMEX | $6,600 | $1,650 | $500 |

| Micro Silver | SIL | COMEX | $2,640 | $660 | $200 |

| Softs | |||||

| Cocoa future | CC | ICE | $11,154 | $2,789 | N/A |

| Coffee future | KC | ICE | $6,930 | $1,733 | N/A |

| Cotton future | CT | ICE | $2,063 | $516 | N/A |

| Orange Juice future | OJ | ICE | $4,256 | $1,064 | N/A |

| Sugar #11 future | SB | ICE | $1,713 | $428 | N/A |

¹Standard Day Trade Margin is offered to most clients with futures trading experience and is available during any open session as long as a $1000 balance is maintained. Strict adherence to the Intraday Margin Policy (provided upon funding account) is necessary to maintain day trading margin privileges.

²The Enhanced Intraday Margin System (EIMS) is available by request from seasoned traders that have familiarity with our platforms and risk management expectations. At least $1000 must be maintained at all times and clients enabled with EIMS, are only permitted to trade from 8:30am CT to 3:50pm CT. Full details and restrictions of the EIMS are outlined in the EIMS policy.

Intraday margin is not available for the Generic Trader Online platform

Margin of any type is provided at the discretion of the risk management department and is subject to change without notice.

Get Started Now!

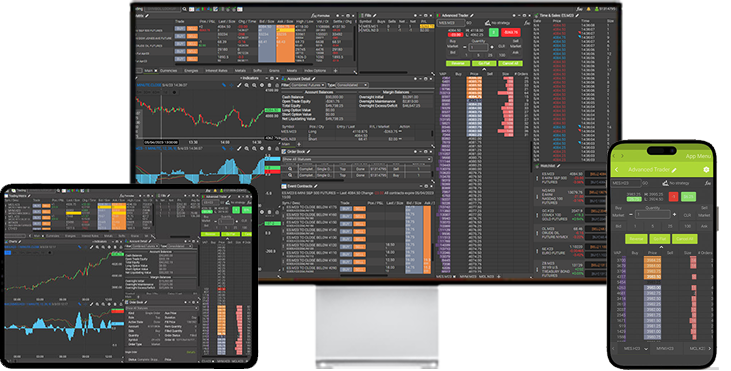

Try out our technology for free or open an account and start trading.

© 2010-2024 Generic Trade.