Generic Trade vs. E*TRADE

| E*TRADE | Generic Trade | |

|---|---|---|

| Mandatory stock trading account required | Yes | No |

| Minimum balance | $1000 | $0 |

| Minimum activity charge | No* | No |

| Real-Time data charges | No | No |

| Specializes exclusively in Futures and Options | No | Yes |

| Commission rates | $1.50 - $2.50 | $0.59 |

| Complete listing of fees for futures accounts located on website | No | Yes |

| Margin for overnight trades | Up to 200% more than exchange minimum margin | Exchange minimum margin or day trade margin available |

| Day trade margin for Index Markets | 50% of exchange minimum margin | 25% of exchange minimum margin, with as low as $50 margins available |

| Day trade margin for most markets | No - only Index markets | Yes |

| Use day trade margin day or night | No | Yes |

| Use day trade margin for IRA accounts | No. IRA accounts require double the exchange minimum margin | Yes, the same as standard accounts |

| 24 hr US based tech support | Yes | Yes |

| Phone, email and chat support | No | Yes |

| Multiple data centers | Yes* | Yes |

| Direct connections to exchanges | Yes* | Yes |

| Trailing Stop Orders available | No | Yes |

| Strategy orders (i.e. OCO, OTO, Trailing Stop, etc.) held on co-located servers | No (not even available) | Yes |

| Futures and Options specific technology | No | Yes |

| Phone orders | $25 | $10 |

| Financial security regulated by NFA and CFTC | Yes | Yes |

| Open a futures account and trade the same or following day | No | Yes |

Prices and services for competitors were obtained on February 16, 2024 and are believed to be accurate, but not guaranteed. Please inform us if any material changes are necessary to this comparison and we will review them immediately. *While we believe this information is accurate, since there was no mention of this fee on the website, it did not specifically state that there was no such fee; our research staff also attempted on multiple occasions to speak with a representative of E*TRADE, but due to excessive wait times they were unable to verify. Also, live chat was also attempted but there were 75-80 minute wait times. **We were unable to determine the nature of their support center due to the aforementioned reason. All commission or ‘execution and clearing rates (as termed by E*TRADE) are quoted in a per contract, per side basis and do not include exchange and regulatory fees. Also for this example, the rates for US exchanges were used and E*TRADE may charge different rates for markets outside the US. E*TRADE® is a service mark and/or trademark of E*TRADE Financial Holdings, LLC, a business of Morgan Stanley. In order to see margins for Generic Trade, as well as a list of any fees we may ever charge, please visit: Fees/Margins

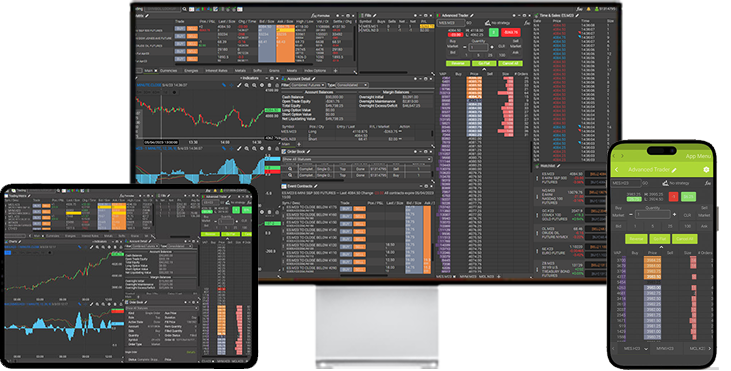

Get Started Now!

Try out our technology for free or open an account and start trading.

© 2010-2025 Generic Trade.