Generic Trade vs. TD Ameritrade

| TD Ameritrade | Generic Trade | |

|---|---|---|

| Minimum balance | $1500.00 | $0 |

| Minimum activity charge | No | No |

| Market data charges | No | No |

| Specializes exclusively in Futures and Options | No | Yes |

| Commission rates | $2.25 | $0.59 |

| Margin for position trades | Exchange minimum margin | Exchange minimum margin |

| Margin for day trading | 25% of exchange minimum margin | 25% of exchange minimum margin, with as low as $50 margins available |

| Day trade margin for IRA accounts | No | Yes |

| Use day trade margin (25%) during any open session | No | Yes |

| 24 hr US based tech support | Yes | Yes |

| Multiple data centers | Yes | Yes |

| Direct connections to exchanges | Yes | Yes |

| All orders held at exchange or at exchange co-located servers | No | Yes |

| Phone orders | $25 | $10 |

| Financial security regulated by NFA and CFTC | Yes | Yes |

| Open a futures account and trade the same or following day | No ("about a week") | Yes |

Prices and services for competitors were obtained on February 26, 2020 and are believed to be accurate, but not guaranteed. Please inform us if any material changes are necessary to this comparison and we will review immediately. All commission or ‘execution and clearing rates (as termed by TD Ameritrade) are quoted in a per contract, per side basis and do not include exchange and regulatory fees. Also for this example, the rates for US exchanges were used and TD Ameritrade may charge different rates for markets outside the US. TD Ameritrade, Inc., a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. . In order to see margins for Generic Trade, as well as a list of any fees we may ever charge, please visit: Fees/Margins

Get Started Now!

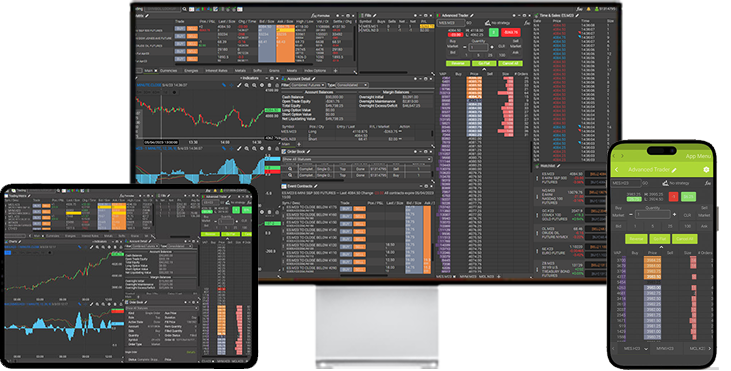

Try out our technology for free or open an account and start trading.

© 2010-2025 Generic Trade.